Understanding Dementia

Dementia affects approximately 500,000 Australians today, with this number projected to increase to over 1.1 million by 2058, according to Dementia Australia. It’s now the

Dementia affects approximately 500,000 Australians today, with this number projected to increase to over 1.1 million by 2058, according to Dementia Australia. It’s now the

Most people are familiar with the idea of working hard for their money. But financially savvy people have a different and more strategic mindset. They

If you’re approaching retirement during today’s roller-coaster stock market, you might feel anxious about your financial future. With super balances fluctuating and economic uncertainty making

1 July 2025 marks a significant milestone for Australian workers’ retirement savings. The superannuation guarantee rate has increased from 11.5% to 12%, representing the final

Evaluate your current situation You can use a retirement calculator, such as MoneySmart1 to roughly estimate how much money you could have when you retire.

With World Environment Day on June 5, many Aussie investors are considering whether environmentally conscious investing is a worthwhile aspect of their financial strategy. Whether

Key points In contrast to last year, the major themes dominating markets in 2025 are: Slowing global economic growth as forecast by the International Monetary

“I don’t have enough assets to worry about a will.” “I’m too young to think about estate planning.” “I’ll get around to it later.” Does

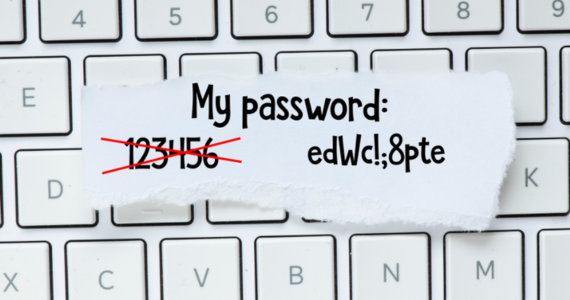

May 1 is World Password Day and serves as a timely reminder to reset your passwords regularly to help keep yourself safe online. Cybercrime can

We all want the best for our kids. Life throws many challenges at them as they grow up, and one that is becoming more and

In recent years and months, market volatility has once again tested the nerves of investors. From the post-COVID recovery to ongoing geopolitical tensions, persistent inflation,

With the financial year end approaching, now is the perfect time to consider making additional contributions to your superannuation. Despite rising living costs affecting households